The credit repair industry is highly competitive, with a total of $4.4 billion market size. Such companies help users overcome their bad credit scores and achieve financial goals quickly. However, reaching prospective clients is not an easy feat by any chance.

With plenty of competitors swarming the market, it is not only crucial to maintain an online presence but also to stay connected with the target audience. A well-planned branding strategy will help you reach more customers, thus ensuring the success of your business.

Why is Marketing Essential for Any Business?

Marketing plays a pivotal role in the success of business organizations and helps increase the ROI significantly. Merely starting a company and hiring employees won’t bring customers, and that’s why promoting your services to the right target audience is necessary. It is also crucial to bolstering your brand’s reputation and visibility.

Marketing activities educate the users about your areas of specialties and help them understand how consulting with your company can benefit them. As a result, you can generate multiple revenue options and set achievable goals. Additionally, marketing helps build your reputation in the industry.

Below are some credit repair marketing ideas that can help in the growth of your company.

Here are 13 Credit Repair Marketing Ideas to Generate More Business

When it comes to marketing, a cookie-cutter approach does not yield positive results. Therefore, you need to analyze what’s best for your organization and how you can contact your potential clients quickly. Some common ideas you must try for your credit repair business are as follows:

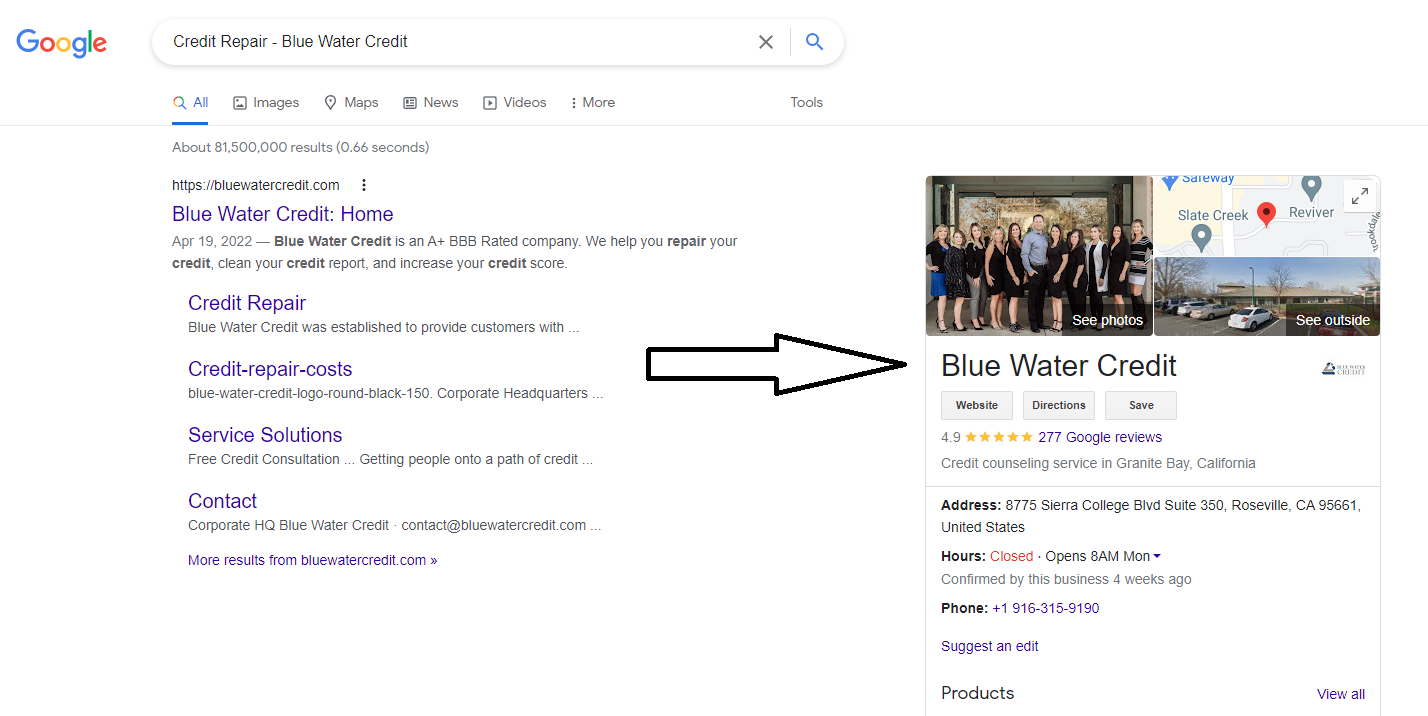

1. Claim your Free Google Business Profile

Google Business Profile is free of cost internet tool meant to improve the visibility of local organizations. It helps provide customers with sufficient information about your company, like working hours, official address, client reviews, ratings, contact numbers, photographs, etc.

According to a study conducted by BrightLocal, 64% of consumers use Google Business Profile to discover nearby local businesses. As such, entering relevant information on this platform can help improve your organization’s visibility in the local region. Additionally, visiting clients can check Google Maps for your office location. Moreover, Google Business Profile will help increase the credibility of your organization as well.

2. Build a Brand that Customers Will Recognize

A brand is a form of business identity and can help a company stand out amongst a sea of competitors. It includes a tagline, advertising message, and a memorable logo to increase cognizance in customers’ minds. For example, your customers are sure to remember a catchy headline or logo describing your company.

After deciding your brand persona and colors, you can use them in several marketing efforts to help maintain consistency. As a result, people searching for credit repair services will be able to identify your organization’s message anywhere. Additionally, building a brand will help you connect with top finance professionals who might be interested in partnering with you.

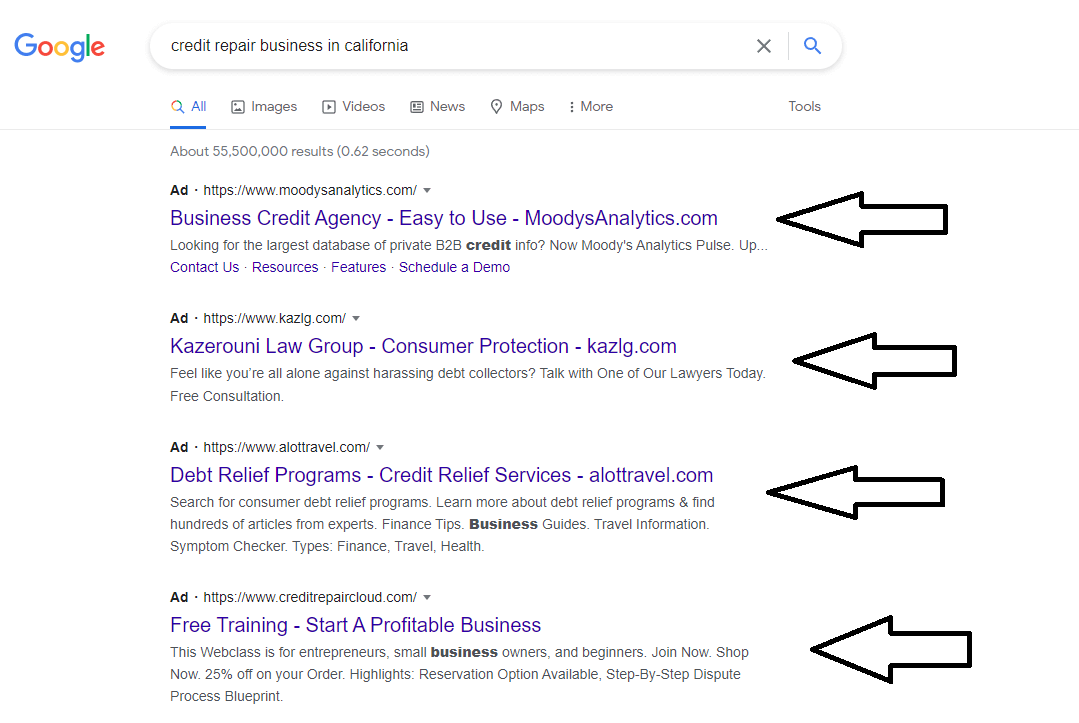

3. Advertise your Services with Google Ads

Investing in Google Ads should be your top-shelf priority to increase visibility to customers requiring credit repair services instantly. In such a case, there’s no time to search through various companies and check their detailed reviews, so most people settle for the advertising organization present on the SERP. These results appear right above the organic listings.

Google Ads is one of the top digital branding tools to help you gain more traffic to your website and improve lead generation. Another point in your favor is that you only pay when someone clicks on your local service or search advertisements. Also, it is easier to customize your ad according to your target audience to get more visibility.

4. Offer Deals with Email Marketing

Simply pushing online advertisements, distributing business cards, or depending on word-of-mouth publicity is not enough. You also need to focus on staying connected with the audience and reaching out to them in a more personalized manner. Email marketing will let you post weekly newsletters and seasonal discounts or send regular updates about your company’s progress to current and new clients.

Here, you can only focus on people with bad credit scores who are likely to invest in your company. As such, you simultaneously save a considerable marketing budget while building brand credibility. You can also track bounce rates or CTR and pivot accordingly.

5. Get Targeted Leads Through Lead Generation Sites

Marketing without lead generation is like getting stuck in the same loop of the target audience. Listing your business on the credit repair lead generation sites will introduce you to people who are more likely to use your services. You can scour through the available proposals and bid on the jobs that seem profitable for your company in the long term.

You can also gain honest customer feedback and work to resolve any recurring issues. Remember, most of these sites are operable on a subscription model. Therefore, set a fixed budget beforehand. Otherwise, it can be easy to lose a huge chunk of your money on these paid platforms. Some common lead generation sites you can try are HubSpot, AeroLeads, Marketo, DeskMoz, etc.

6. Turn your Website Visitors into Potential Customers

Once people have landed on your website after clicking an advertisement, they need a reason to stay on the page. The site acts like a digital portfolio that speaks a ton about your organization. If there’s not sufficient information, people will eventually leave.

So, how can you make it better and reduce the bounce rate? Here are a few pointers depicting the type of content a website should have:

- Your business information like contact numbers, a branding message, etc.

- List of all the services offered to clients

- Address of office branches

- Impactful CTA to book an appointment online

7. Build and Execute SEO Plan for your Website

SEO (Search Engine Optimization) tactics can help improve your website’s visibility and rank it higher on various search engines. As such, when someone looks for a ‘credit repair servicing company,’ your name will pop up first.

To make your website SEO-friendly, you can follow the below-mentioned steps:

- Post your company name, address, and contact information on all web pages.

- Search for most used keywords like ‘credit repair near me,’ ‘credit repair services,’ etc., and use them wisely.

- Regularly publish blogs on topics your target audience will like to read.

- Formulate connections with other relevant websites by using more backlinks.

- Also, register your business on various platforms like Yelp, Bing, etc.

- Track Google Analytics data to overcome any gaps in your SEO strategy.

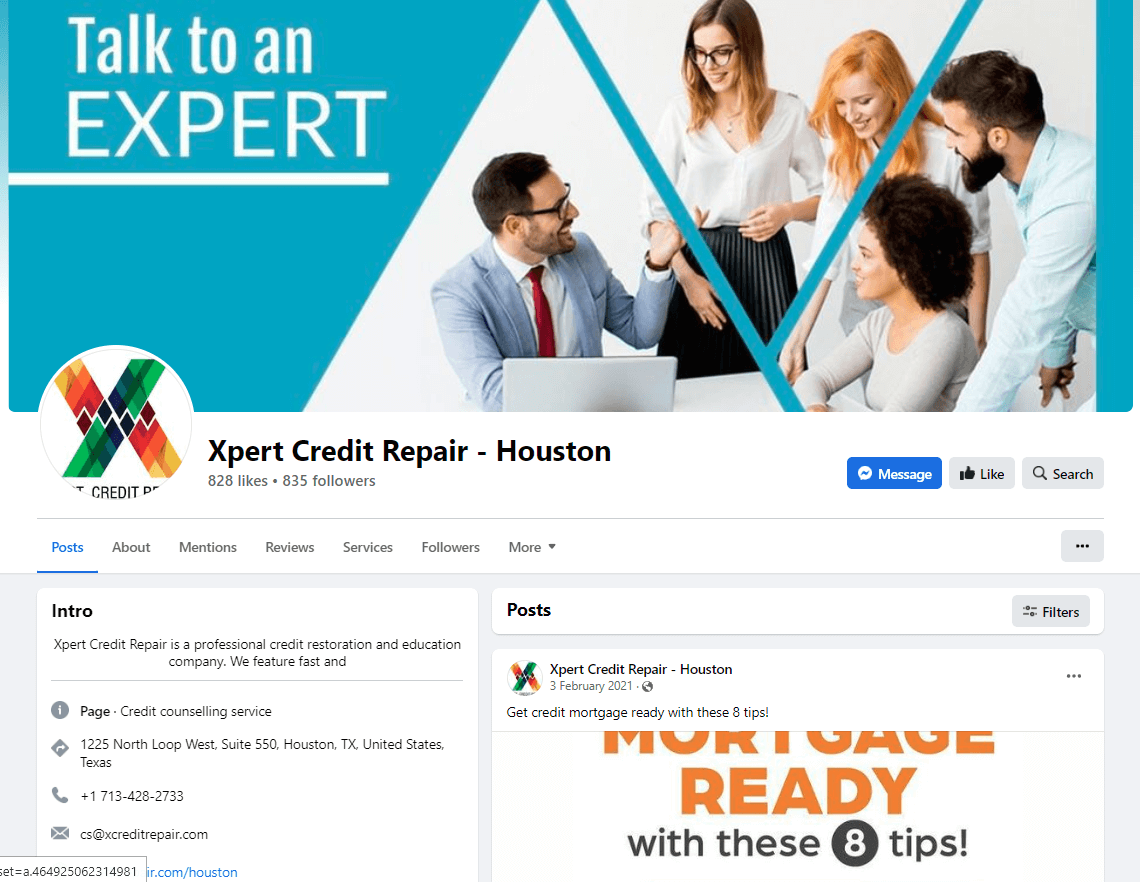

8. Set Up your Facebook Business Page

Facebook is a goldmine of opportunities that can work in your favor if you deal with the cards correctly. With over 93% of businesses having a Facebook page, you must make a mark in the territory. Doing so will help you gain exposure to millions of people using the social media platform. However, you must always post consistently to maintain proper engagement with the users.

Optimize the page with helpful information like company details, a list of services offered, client reviews, exclusive testimonials, etc. Also, add creative ads or team photos to make your credit repair brand seem more legit. Simultaneously, encourage your current clients to post reviews to influence more users to try your services. As a result, your profile will attract more potential customers and help you generate revenue.

9. Use Social Media to Market your Business

Social media has made digital branding available for all organizations, big or small. Regardless of your budget, you can create online accounts and start posting content relatable to the credit repair industry. You can make funny skits, post market statistics, write case studies, etc.

You can create and post content on platforms like Instagram, TikTok, Twitter and LinkedIn to reach a wider audience and spread brand awareness amongst people. Additionally, social media marketing will help generate conversation about your company and give your clients a unified space to interact with each other. It will further result in the word of mouth publicity for your audience. Based on the current trends, you can also invest in influencer marketing.

10. Build Trust with Positive Customer Reviews

A bad credit score is a highly stressful situation for individuals looking to procure loans to purchase a house or car or to invest in their business. Needless to say, people want to work with a company that is trusted amongst its clients and is known for producing satisfactory results.

Therefore, ask happy customers to share their experiences with your company online. You can then promote it on social media accounts, marketing flyers, testimonial sections on the website, etc. Hearing straight from previous customers will reinforce confidence amongst your new clients. However, don’t repeatedly pester clients to post reviews or you might end up gaining a negative reputation.

11. Win More Referrals with a Customer Referral Program

Think about it – what if your present clients could bring in more revenue? Implementing a customer referral program will allow you to gain more prospective clients without spending much money. All you need to do is contact your satisfied customer base and ask them to discuss your credit repair services with their friends or family.

To further sweeten the deal, you can add incentives like branded products, gift cards, or fixed discounts on the first consultation or overall fee. You can request a referral via text or email after the credit score has been revived.

12. Create and Share Expert Content on Blog

Credit repair is a highly informative field where you can share financial tips and do’s and don’ts with your audience. Creating a website blog and posting educational content will help you stay on top of the mind of people with bad credit scores.

Some of the topics you can explore are – ‘how to improve your credit score’ or ‘reasons for a bad credit score‘ etc. While posting such content, remember to use proper keywords, relevant images, and divide the text into different subheadings. You can also add a Call-to-Action to your services in the end to convince the reader to get in touch with your team.

13. Get New or Repeat Marketing Business with Alternative Marketing Methods

A single marketing strategy can’t help you reach the majority of people. Depending only on one marketing source will be a disaster if you want to reach both millennials as well as senior citizens. For example, direct print marketing won’t work for millennials, and social media channels won’t reel in older people.

Therefore, you must try a mix of alternative branding ideas and mediums according to the target audience demographics. You can also consider offbeat options like distributing fridge magnets, postcards, stickers, van wraps, etc. Such products will remind people about your services and help them pick your brand subconsciously.

Conclusion

Establishing yourself as an industry leader in a fiercely competitive field like credit repair requires heavy marketing efforts from your end. You can’t simply wait for potential customers to discover your services out of nowhere.

In today’s digital era, branding is available to all and can help bring more revenue to your company. You can start by developing an optimized website, posting on various lead generation sites, operating social media accounts regularly, etc.

An online presence will allow more people to understand your company’s vision. As such, you will undoubtedly notice a rise in the sales figures. Look into YesAssistant to gain more information about various services like website development, social media marketing, content writing, SEO etc.